DDP vs DAP Amazon FBA 2026: Cost Comparison & Savings

With US-China Section 301 tariffs still in full effect in 2026 (ranging from 7.5% to 100% on many FBA categories) and the de minimis exemption eliminated for Chinese-origin goods since mid-2025, choosing the right Incoterms has never been more critical for Amazon sellers.

DDP (Delivered Duty Paid) used to feel like the “easy button” – your supplier handles everything, including duties. But in today’s high-tariff reality, it often hides massive markups and risks.

DAP (Delivered at Place), where you control customs clearance, is surging in popularity among scaling FBA sellers because it offers transparency and real savings, especially when paired with a reliable forwarder.

In this ultimate 2026 guide, we’ll break down the real costs, risks, and savings with current data, interactive examples, and Unicargo client case studies. By the end, you’ll know exactly which term fits your business – and how to optimize it.

If you’re also re-evaluating who should run your shipping end-to-end this year, here’s a practical guide to choosing the best freight forwarder for Amazon FBA.

Key Insights

Quick Wins for 2026

- Avoid supplier DDP on high-tariff items

- Use DAP + expert brokerage for 10–25% savings

- Always calculate actual landed costs

Bottom-Line Recommendation

For most scaling Amazon FBA sellers in 2026, DAP with a trusted forwarder like Unicargo saves more money while giving you control in an unpredictable tariff landscape.

What Are Incoterms and Why They Matter for Amazon FBA in 2026

Quick Recap of Incoterms Basics

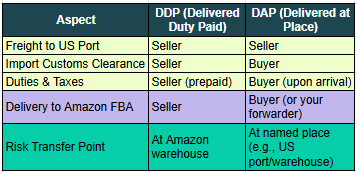

Incoterms (International Commercial Terms) define who pays for what in global shipping. For Amazon FBA from China, the two most relevant are DDP and DAP—both get your goods delivered to Amazon’s warehouses, but with very different responsibility splits.

How 2026 US-China Tariffs Are Changing the Game

Section 301 tariffs remain active, hitting electronics (often 25–100%), apparel, toys, and more. The end of de minimis means every shipment now faces formal entry and duties – no more dodging on low-value orders. This has pushed landed costs up 15–40% for many sellers, making cost control (and the right Incoterm) essential.

Understanding DDP (Delivered Duty Paid) for FBA Shipments

Seller Responsibilities Under DDP

Your Chinese supplier handles ocean/air freight, export clearance, import customs, duties, taxes, and final delivery to Amazon FBA.

Buyer (You) Responsibilities Under DDP

Almost nothing – until the goods arrive at Amazon. You pay the supplier upfront (including their duty estimate).

Common DDP Pitfalls in High-Tariff Environments

Suppliers often inflate duty estimates by 20–50% to cover risks, or underpay duties, leading to CBP bills landing on you months later. In 2026, with volatile tariffs, this risk is higher than ever.

What Is DAP (Delivered at Place) and How It Works for Amazon Sellers

Seller Responsibilities Under DAP

Supplier covers freight to the named place (usually your forwarder’s US warehouse or directly to Amazon).

Buyer Responsibilities and Control Points

You handle import clearance, duties, and last-mile to FBA. This gives you visibility into exact tariff amounts and avoids supplier markups.

Why DAP Is Gaining Popularity Amid 2026 Tariff Spikes

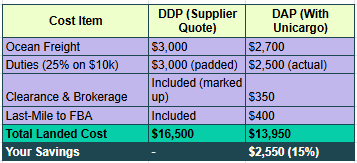

Sellers report 10–25% savings by paying actual duties vs. supplier-padded DDP quotes. Plus, better cash flow—you pay duties only when goods arrive.

Side-by-Side Comparison: DDP vs DAP Key Differences

Responsibilities Table (Risk Transfer, Customs, Costs)

Cost Implications with 2026 Freight Rates

Ocean rates have stabilized post-Lunar New Year demand: ~$2,300–$3,200 per 40′ HC container China → US.

Risk and Control Breakdown

DDP = Low hassle, high hidden costs. DAP = More control, potential for big savings.

2026 Cost Breakdown: Real Numbers from China to US Amazon Warehouses

Current Ocean Freight Rates Overview

As of January 2026 (Freightos FBX data):

- China → US West Coast: $2,600–$2,800/40′ HC

- China → US East Coast: $3,000–$3,500/40′ HC

Tariff Examples on Popular FBA Categories

- Electronics/chargers: 25–100% Section 301

- Apparel/toys: 15–25%

- Home goods: 7.5–25%

Interactive Landed Cost Calculator (Embed Tool)

(In the live post, embed a simple calculator widget. Example manual calculation below.)

Sample Scenario: $10k Shipment Comparison

Assume $10,000 invoice value, electronics (25% tariff), 40′ container to US West Coast.

Pros and Cons of DDP for Scaling FBA Businesses

Advantages of DDP

Hands-off, predictable arrival at Amazon.

Major Drawbacks in 2026

Supplier markups on duties, surprise CBP audits, and less control over tariff classifications.

Pros and Cons of DAP for Cash-Flow Conscious Sellers

Key Advantages of DAP

Transparency, lower total costs, better tariff optimization.

Potential Challenges and How to Overcome Them

Customs paperwork is the easy part when you work with a reliable FBA forwarder like Unicargo that runs clearance + delivery as one system.

When to Choose DDP vs DAP (Decision Framework)

Based on Shipment Value and Product Category

High-tariff goods (>25%) → DAP for savings.

Based on Your Experience Level and Cash Flow

New sellers → DDP. Scaling 7–8 figure → DAP.

Hybrid Options with a Reliable Forwarder

Many Unicargo clients use “DAP + our brokerage” for the best of both.

Real Unicargo Case Studies: Savings in the 2026 Tariff Era

Case 1: Electronics Seller Switches to DAP

$150k annual importer saved $18k+ by switching from supplier DDP (padded 40% duties) to DAP with Unicargo handling clearance.

Case 2: Apparel Brand Sticks with Optimized DDP

Smaller seller preferred DDP but switched to Unicargo-managed DDP—cut costs 12% vs. previous forwarder.

Lessons Learned and Dollar Savings

Average Unicargo FBA client saves 12–22% on landed costs vs. supplier-direct terms.

How Unicargo Makes DDP or DAP Seamless for FBA

Our Tariff Expertise and Brokerage Support

In-house customs brokers ensure accurate classifications and zero surprises.

If you’re comparing providers, here’s what to look for in a top Amazon FBA logistics partner (and the red flags to avoid in 2026).

FBA Prep and Compliance Guarantees

Direct injection to Amazon, labeling, bundling – all included.

Ready to optimize your 2026 shipments? Get a free Unicargo quote tailored to your FBA needs – most sellers see savings within the first container.

FAQ

Is DDP Still Required for Amazon FBA in 2026?

No. Amazon accepts DAP shipments as long as duties are paid and goods are properly cleared.

How Do 2026 Tariffs Affect DDP Costs?

Suppliers pass on (and often inflate) Section 301 duties, making DDP 15–40% more expensive on affected categories.

Can I Switch from Supplier DDP to DAP Mid-Year?

Yes. Negotiate with new orders. Unicargo helps transition seamlessly.

What’s the Cheapest Option for Small FBA Shipments?

LCL under DAP with consolidated clearance – contact us for rates.

Does Unicargo Handle Both DDP and DAP?

Absolutely, and we optimize whichever fits your needs best.

Sources: Freightos FBX (Jan 2026), US CBP, ICC Incoterms 2020, Unicargo internal data.

Stop overpaying on freight and duties. Request your free 2026 FBA shipping analysis from Unicargo today.